Which classic cars make the best investments?

- 17th December 2015

- News

- Posted by kwecars

- Leave your thoughts

Classic cars have excelled as an investment asset class, with the value of the Historic Automobile Group International index rising by 16% in 2014. Yet it is more ‘modern’ vehicles that are able to grow in value and are attracting investors’ attention. Managing director, Chris Knowles spoke to the editor of Investment Week about which classic cars are best to invest in.

The full article can also be viewed here.

The classic car market is now worth more than £6bn in the UK, employing thousands across the country as demand increases. This growing market falls in line with the fact that more motorists are turning to classic cars as their vehicle of choice.

Owning a modern car can be frustrating, as its value depreciates rapidly within the first 12 months of ownership. Comparatively, a classic car is more likely to retain its value – it may actually increase if restored and maintained to a high standard. For some, the decision is driven by nostalgia, while for others it may be the desire to stand out from the crowd.

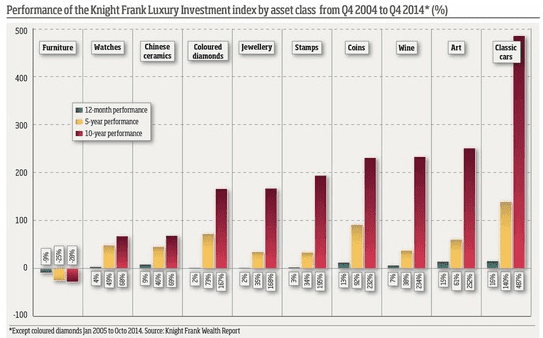

The Knight Frank Luxury Investment index recently noted that classic cars have beaten everything from art, watches, gold and coins over the past one, five, and 10 years (see chart, below).

The group noted that the value of the Historic Automobile Group International index has risen by an astounding 487% over the past 10 years and grew by 16% in 2014.

These strong returns have pricked the ears of many eager investors looking to benefit, but which classics are leading the way?

Stand out from the crowd

Choosing which classic car to invest in can prove costly – particularly as the market is becoming increasingly lucrative. Big name Ferraris and Lamborghinis are likely to set you back a hefty sum. Last year, for example, a 1962 Ferrari 250 GTO sold for $34.65m at auction – making it the most expensive car in history.

Owning such a pricey vehicle takes the fun out of classic car ownership, as there is no way you can take this million dollar supercar for a quick spin without instantly depreciating its value.

Yet classic car investment need not be so costly, as current market trends point favourably in the direction of more affordable ‘modern classics’.

Cars from the 1970s to the 1990s are beginning to make up ground on their predecessors, with classic Aston Martins, Ferraris and Porsches inevitably holding their own. If you are looking for a solid, long-term investment, however, one marque stands out among the sea of its competitors: Jaguar (see table, below).

When thinking of a classic Jaguar, we arguably think of the iconic E-Type, which continues to set investors back a large sum, without much of a return on investment. Its somewhat lesser known, younger siblings – the XJ-based models of the 1970s-1990s – are making a well-deserved resurgence, as their value begins to increase in line with growing demand.

The stand out investment of the moment would have to be the Jaguar XJS, which recently celebrated its 40th anniversary. Throughout its life, the XJS was a car that confounded critics, but won over enthusiasts and succeeded in returning its investment to the company.

Considered by many as an unworthy successor to the E-Type, it proved its worth by achieving a longer production run and outselling its predecessor by 43,000 cars. In recent times, the XJS has arguably become more desirable than ever, and even at 40, its price continues to soar.

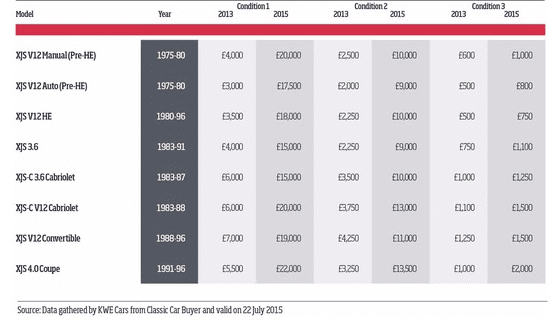

Taking into account data collected from Classic Car Buyer, many XJS models in A1 condition have increased in value by up to five times since 2013, as seen below, and the XJS continues to be named as one of the hottest modern classics to invest in right now.

How to source a top quality classic

It is firstly important to consider that sellers – in particular garages and dealers – will have gone to some trouble to make the car look pristine on the outside. A perfect-looking car is often in much worse condition than one with visible rust, which has not yet been ‘tarted-up’.

As with all cars made of steel, the most important area to consider is rust, both the less visible painted areas and, more importantly, the hard-to-see underside and hidden cavities. The most expensive part of a restoration is usually the stripped re-spray. If you are careful in selecting a low-rust car, you could save around £10,000.

City cars are often in worse condition, as they are usually only used for shorter journeys. A seemingly low mileage vehicle may have completed a lot of shorter journeys, which can lead to worn out brakes, door hinges, leather and carpets.

Speak to the classic car experts

If you need help sourcing a classic car or Jaguar XJS, or would like expert engineering advice, feel free to give us a call on 01635 30030. We have many years of experience restoring classic cars back to ‘better than new’ quality.